Mid-income brands drive more business than luxury brands

Among these retail brands are Coca-Cola (1), Apple (2), IBM (3), GE (6), McDonalds (7), Samsung (9) and Toyota (10). Likewise, included in the top five fast-gainer brands in 2012 are Apple, Samsung and Nissan.

Not surprisingly, only 10 high luxury brands made it to the list of Interbrand’s 100. These include Mercedes Benz (11), BMW (12), Louis Vuitton (17), Gucci (38), Hermes (63), Cartier (68), Tiffany & Co. (70), Porsche (72), Burberry (82), Harley Davidson (96) and Ferrari (99).

Why targeting mid-income consumers is far more profitable

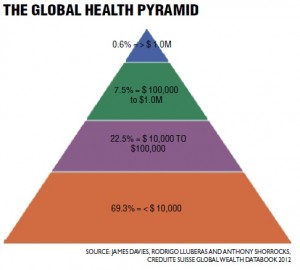

The Credit Suisse Global Wealth Report 2012 reveals that 1,035 billion adults, or 22.5 percent, of the entire world population make up the global middle-income class. These are individuals with a net worth of between $10,000 and $100,000.

In contrast, about 3,184 billion adults, or 69.3 percent, of the world population belong to the bottom of the pyramid (BOP) with an individual net worth of less than $10,000. Globally, there are 373 million adults in the high segment of the wealth pyramid constituting 7.5 percent with a net worth between $100,000 to $1 million while a mere 0.6 percent equal to 29 million individuals have a net worth above $1 million. These individuals belong to the apex of the global wealth pyramid.

Thus, in terms of user and usage potential in marketing brands, there is a far greater market reach at 22.5 percent of middle-income individuals than an estimated 8.1 percent of high or ultra-high net worth individuals. Moreover, depending on the country profile particularly with BOP countries, the prevalence of high net worth individuals decreases.

Who is the mid-income consumer

The first ever research on social classes conducted by Lloyd Warner and Paul Lunt in 1950 continues to be valid to this day and cites a six class social system: the Upper-Upper or old families; Lower-Upper or the newly arrived; Upper-Middle, mostly the professionals and successful businessmen; Lower-Middle or the white-collar salaried class; Upper-Lower or the wage-earner, skilled worker group; and the Lower-Lower or the unskilled labor group.

Warner and Lunt’s research index was based not on the amount of income but on type or source of income, type of occupation, house type and place of residence.

Three ways to reach the mid-income market

Experience based, rather than pure utilitarian. Middle class consumers are more likely to spend on activities that are experience-centered, more than the purely functional, tangible goods that the lower social class is bent on accumulating. Memorable experiences like travel, education, sports and other forms of recreation are a common favorite. When it comes to tangible items, goods that promise memorable experiences are far more attractive.

In 2012, Apple rose to No. 2 as the world’s most valuable brand with a whopping 129 percent increase in brand value at $76.5 billion. Apple iPhones, iPads, iPods, Macbooks are must-own products that signal a better quality of life, entertainment and experience. No wonder every mid-income household aspire and are bent to have this brand.

Talk savings, rather than spending. With upward mobility, more spending money and purchasing power, the middle income market are more likely to look into long-term needs, goals and aspirations. They are likely to engage in security products and investment spending like insurance and a home. Not uncommon is to see the mid-income load up their homes with tangible goods and consumer durables that have better quality and longer life spans. On the contrary, much of the BOP invests in flashy and branded clothing. Also, cars are likely to be the first major investments of the lower income.

Pre-occupied with mid-income status symbols. Social classes have their own status symbols. Preferences in shopping destinations and shopping goods and services change as individuals move up social classes. H&M, Uniqlo, Cotton On, Body Shop, Nike, Converse, Apple, Samsung, Wal-Mart, Target, Kmart, Toyota, etc., attract clusters of mid-income individuals as opposed to high-luxury brands like Louis Vuitton, Gucci, Hermes, Nordstrom, Porsche and Rolls Royce.

Reaching the mid-income market means co-branding or collaborating with other mid-income brands and being placed in shopping locations where the mid-income market converges.

The writer is chief brand strategist of MKS Marketing Consulting and is an adjunct faculty at the Asian Institute of Management and may be reached at kdeasis@skyinet.net.