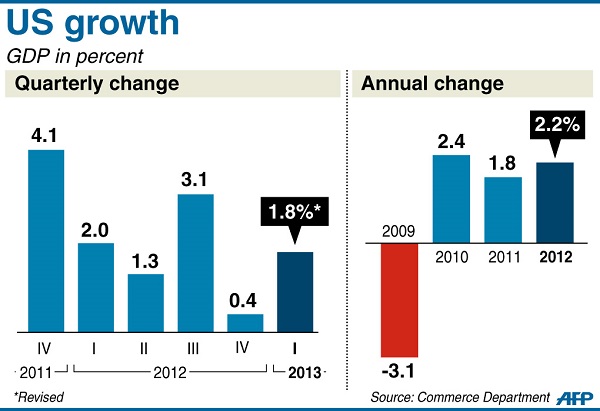

US stocks, bonds surge as Q1 growth cut to 1.8%

WASHINGTON—The US economy grew at a pace of just 1.8 percent in the first quarter, the Commerce Department said Wednesday, in a sharp downward revision that sent bonds and stocks higher on hopes of more stimulus from the Federal Reserve.

Consumer spending and trade were both much slower than previously estimated as the weak spot that began in late 2012 persisted into the new year amid a rise in payroll taxes and cuts in government spending.

The final revision of the growth data surprised economists, who had expected that the preliminary picture of a stronger rebound in the January-March period, with growth running at 2.4 percent, would be unchanged.

Consumer spending grew only 2.6 percent in the quarter, compared to the previous estimate of 3.4 percent, shaped in part by an 8.6 percent contraction in disposable personal income.

Trade in both directions contracted, against previous estimates that imports and exports had grown.

Exports shrank 1.1 percent in the quarter, and imports—which act to lower growth in GDP calculations—contracted 0.4 percent.

Another sharp revision was business investment in buildings and other structures, which shrank by 8.3 percent in the quarter, compared to the earlier estimate of just a 3.5 percent contraction.

Government spending cuts also pulled GDP lower: the federal government’s contribution to growth contracted by 8.7 percent, while for state authorities the contraction was 2.1 percent.

The numbers reflected the persistent drag on the economy of both tight government and personal spending, which held back the rebound from the final quarter of 2012, when the pace of growth was only 0.4 percent.

Analysts blamed the payroll tax increases that kicked in in January, and fears about government spending cuts introduced in March, that encouraged US households and businesses to hold back.

“This means that income is not driving the economy,” said Steven Ricchiuto, chief economist at Mizuho Securities.

Instead, he said, the driver has been the Federal Reserve’s $85 billion-a-month stimulus program, buying bonds to hold interest rates low.

The new data then raises questions about whether the Fed will stick to its forecast, announced last week by chairman Ben Bernanke, that the program could be tapered from later this year and wound up completely by mid-2014 if growth keeps up.

The prospect of tighter money conditions and higher interest rates due to a shrinking stimulus program had sent bond and stock prices sinking.

But Wednesday’s data supported a longer-term picture for stimulus, and sent buyers back into the markets.

The S&P 500 closed up 0.96 percent at 1,603.26, and the Dow Jones Industrial Average added 1.02 percent to 14,910.14. Bonds also surged, with the yield on the benchmark 10-year Treasury bond falling 0.05 percentage points to 2.54 percent.

Although most economists say growth in the second quarter has been firmer than expected, the fresh data could temper some of the optimism.

“The question is how the Fed interprets these numbers,” said economist Paul Edelstein at IHS Global Insight.

“They might decide to wait to taper bond buying until next year, as fiscal austerity could take a bigger bite out of growth in the absence of sufficient monetary stimulus.”

Economist Jennifer Lee of BMO Capital Markets said: “If we end up with three consecutive quarters of sub-2 percent growth, the Fed won’t taper under those conditions. They need convincing signs of a pickup before they turn off the taps.”—Paul Handley