Local stock index falls for 3rd straight day

MANILA, Philipines—The US Federal Reserve’s signal to end its aggressive monetary stimulus alongside jitters over China’s economic slowdown continued to drag down local financial markets.

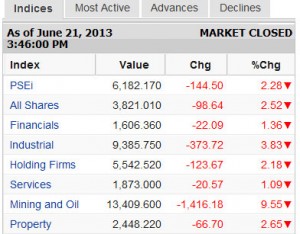

The main-share Philippine Stock Exchange index lost 144.5 points or 2.28 percent to close at 6,182.17, weakening for the third straight session alongside the decline in most markets across the region.

For the week, the index lost 60.09 points or close to 1 percent from last week’s finish of 6,242.26.

All counters were in the red but the mining/oil counter was the most battered for the day, declining by 9.55 percent due to the sharp decline in Semirara (-11.54 percent) and Philex (-11.42 percent). Dealers this reflected the slump in global commodity markets.

Foreign investors continued to pull out funds from the local market, resulting in a net foreign selling of about P2.27 billion for the day. Total net foreign selling amounted to P9.12 billion versus net buying of about P6.85 billion, based on PSE data.

Other big index decliners were RLC (-10.67 percent), AP (-9.94 percent), MWC (-8.84 percent), EDC (-7.63 percent), FGEN (-5.98 percent), Megaworld (-5.93 percent), JG Summit (-4.41 percent) and SM Prime (-3.94 percent).

Value turnover was heavy at P12.97 billion. There were over four decliners for every single gainer at the market.

The market continued to factor in the US Fed’s unwinding of its aggressive bond-buyback activities. After US Fed chair Ben Bernanke’s hint that monetary stimulus would end in 2014, the market is now expecting the Fed to cut back on its monthly bond purchases by September and terminate such activities by June 2014.

Asia has seen an outflow of global funds in the last five weeks. Citigroup estimated that in the week ended June 19, there was net foreign selling worth $3.6 billion in Asia, with Korea and Taiwan taking up the largest stake. But Citigroup estimated that Japan still had a small net buying.